Smartphones have changed the way we used to interact with finance-related activities. Whether it is about sending money within our nation or overseas, we are always just a few taps away with finance apps. These apps have even replaced our physical wallets with digital wallets. But, have you ever wondered what happens behind the scenes when we add a credit card and pay using our iPhone and Android devices? In this post, we are going to explore the same. We will understand how Apple pay and Google pay work when we initiate a transaction through NFC or E-commerce platforms.

The article will first explore the stats on the usage of Apple pay and Google pay worldwide. Later, we will explore the steps by understanding the complete architecture when we initiate a transaction.If you are also looking for mobile apps development service to build a mobile payment app like Google or Apple Pay, this article will help you gain the essential technical knowledge. Without any further ado, let’s head straight into our article.

Table of Contents

What stats speak about Apple Pay and Google Pay?

People worldwide are shifting to mobile apps to perform their payment transactions. Apple pay and Google pay reveal some interesting statistics and facts; let’s check them out.

Apple Pay statistics and facts

- Of 2.3 billion mobile wallets, 507 million are Apple Pay.

- 5480 banks support Apple pay worldwide

- By 2025, apple pay transactions will increase from 5% to 10% worldwide

Google pay statistics and facts

- In 2022, Google pay is the leading mobile payment method

- 800000 websites have Google pay support.

- Most stores, even small vendors in India and Russia, utilize Google Pay.

- Mobile wallets will exceed $80 billion by 2026.

Undoubtedly, by 2025, Google and Apple Pay will be the default payment transaction apps worldwide.

Google Pay and Apple Pay working- steps and architecture

What exactly happens behind the scenes when a payment is initiated through these popular finance apps? Let us start with Apple pay and later move to Google Pay.

How does Apple pay work?

There are several steps behind the scenes when you add a card and pay using Apple Pay.

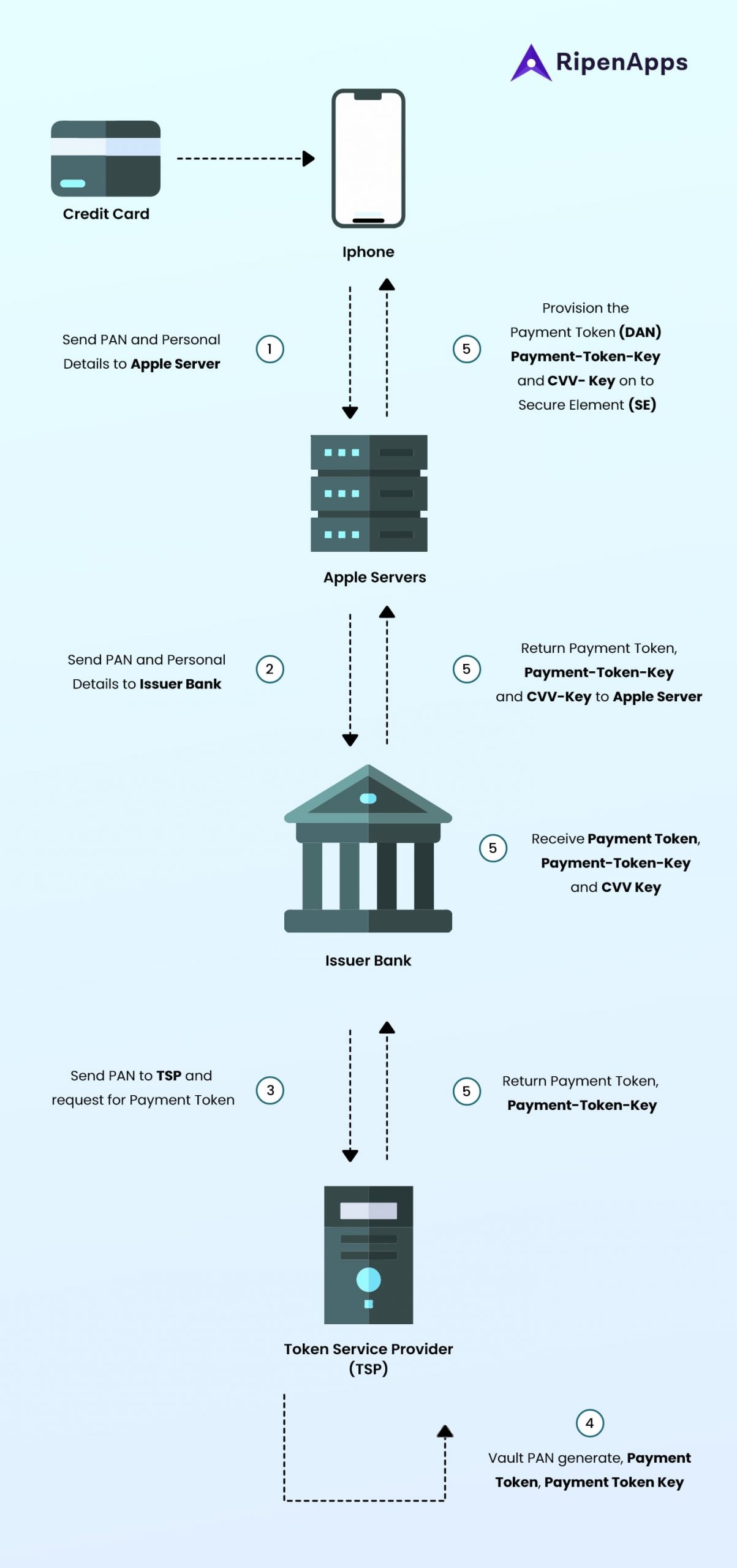

Adding the card to Apple Wallet

- When you add a card to Apple Pay providing PAN (Primary Account Number) and other card information, the information is sent from the Apple Wallet app to Apple’s pay server.

- Apple Pay Servers verify the information and send it to your issuer bank.

- Issuer bank communicates with Token Service Provider who is registered with EMVCo organization.

- Once the Bank receives the Payment Token, they return it to the Apple Pay Server.

- Appel pay with their own Trusted Service Manager stores the data on the chip of the iPhone device as DAN (Device account number)

- Apple uses this DAN every time instead of a Card number whenever you pay using Apple Pay.

- No information is saved on Apple’s server or any database of Apple other than DAN which is just a reference to the Credit Card and not the exact credit card.

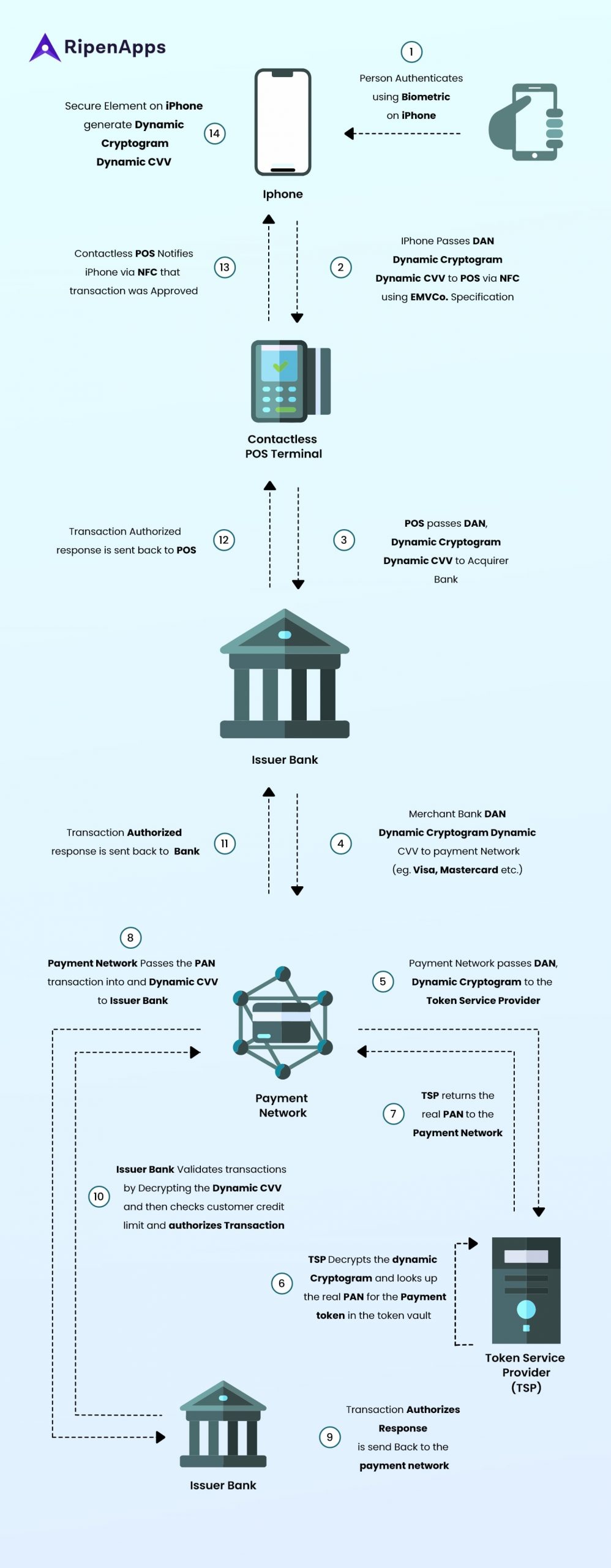

Paying with the Apple Pay

- Your iPhone authenticates the secured information stored on the chip when you pay using Apple Pay.

- The DAN along with additional technical elements like Dynamic Crpytoprogram and Dynamic CVV values are transferred to POS machines.

- The POS conveys the request to the Merchant bank, and then the request is transferred to the issuer bank.

- Once the issuer bank authenticates the transaction, you get a green check on your device with the Transaction Approved claim.

This entire process is performed in a few seconds providing great flexibility to the customers using Apple Pay.

Read Also: An Exclusive mWallet App Development Guide

How does Google pay work?

Technically, Google Pay has a similar process of adding the card and payment. But the terms and architecture work a bit differently than Apple Pay. Here is how Google pay works.

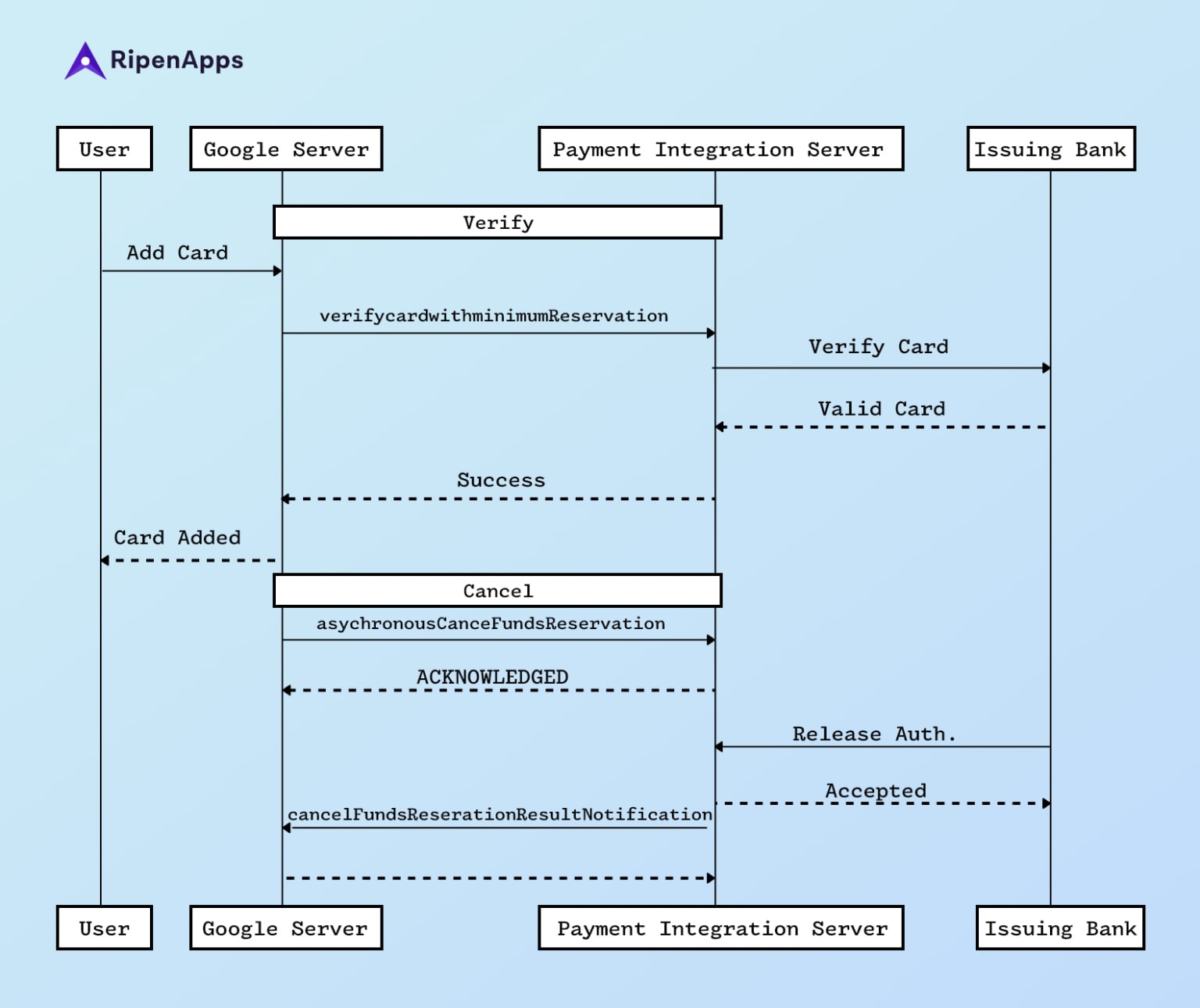

When the card is added

- The user sends the request to add the card.

- The request goes to Google Server for further interpretation.

- Google server reaches to Payment Integrator API to activate the code to verify payments.`

- The Payment Integrator server communicates with the issuing bank to verify the details of the credit/debit card and responds with “accepted” or “rejected.”

- The payment integrator server communicates back to the google server about the status.

- And finally, the user gets a “card added” message on their screen.

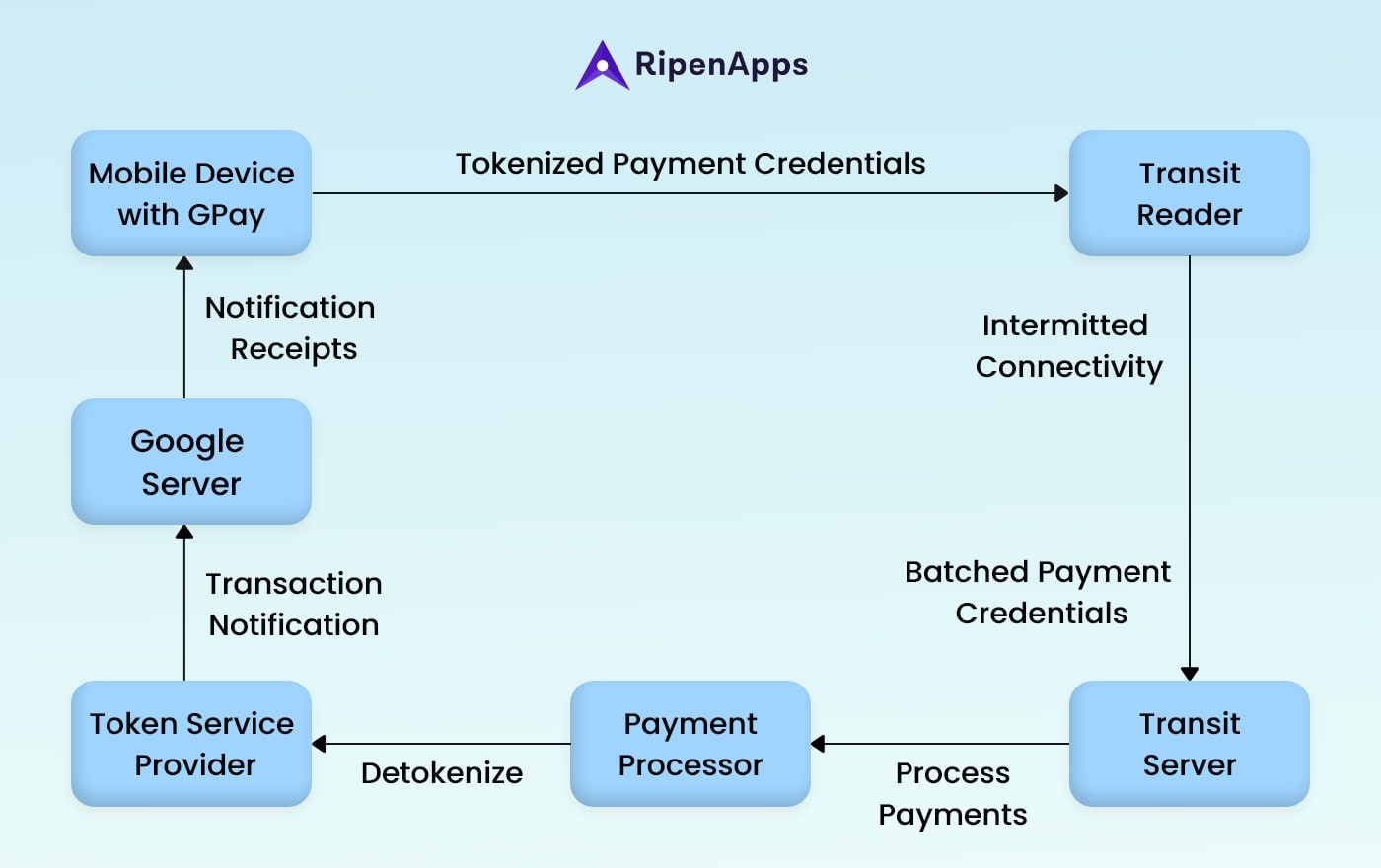

When making a payment with Google Pay

- Once the card is added, users’ mobile devices, through the Google pay app, communicate with the transit Reader at the Merchant’s location.

- Google server activates tokenization process. The tokenization process creates the payment token keeping the card information secure.

- The transit server verifies the cards and later sends the request to the payment processors.

- Payment processors read the encrypted Tokenized payment credentials and communicate with the bank.

- The bank communicates with the token service providers to further secure the payment token and make it ready to go back to the google server.

- The google server sends a notification and receipt to the user either as “successful” or “failed.”

Again, with Google Pay, the complete process is conveyed within seconds delivering a flexible approach to payment to the customers.

Ending words

The mobile app market is continuously watching a steep rise in the injection of Finance apps. Apple Pay and Google Pay are the top players, but we can see several entrepreneurs have launched their apps and some are planning to build one. Building a finance category app that can work like Apple Pay and Google Pay requires you to choose the right fintech mobile app development companies. And, if you are looking for one of the partners, RipenApps is just a click away from the consultation.

India

India USA

USA Australia

Australia Canada

Canada UK

UK UAE

UAE