AI and ML have brought a dramatic change in the finance industry. From traders to investors and banks to financial companies, every business entity today leverages the powerful capabilities of artificial intelligence and machine learning in their financial services & strategies.

The emergence of AI and ML in finance is empowering businesses and users to take advantage of emerging technology trends and generate better ROI from their investments.

Being an aspiring entrepreneur or fintech startup, you should know how AI and ML are transforming the finance sector. In this blog, we will be discussing the role and impact of AI and ML in the finance industry.

So let’s get started

Table of Contents

Current Market of AI and ML in Finance Industry

Artificial intelligence and machine learning are advanced and innovative technologies. It empowers a system or software application with human-like abilities to perform intelligent actions. These AI and ML-powered financial applications enable business owners to enhance performance and generate better ROI.

Many leading app design companies and mobile app development consulting firms incorporate AI and ML in finance to develop intelligent financial software solutions.

Therefore, the demand for integrating AI and ML in finance is growing significantly. At present, financial companies, business people, and fintech app development companies use AI and ML in finance for various purposes.

If you look at the current market statistics, you will find the demand for AI app development services and machine learning in the finance sector is increasing. Here is the data

- 85% of financial companies are using AI in their services.

- 52% have developed AI-powered financial products and services.

- AI in finance industry is set to reach $26.67 Billion by 2025.

- AI in fintech market is projected to reach $14.41 Billion in 2024 at a CAGR of 27.1%.

Also Read: Fintech Vs. TechFin: Predicting The Future of Finance and Banking

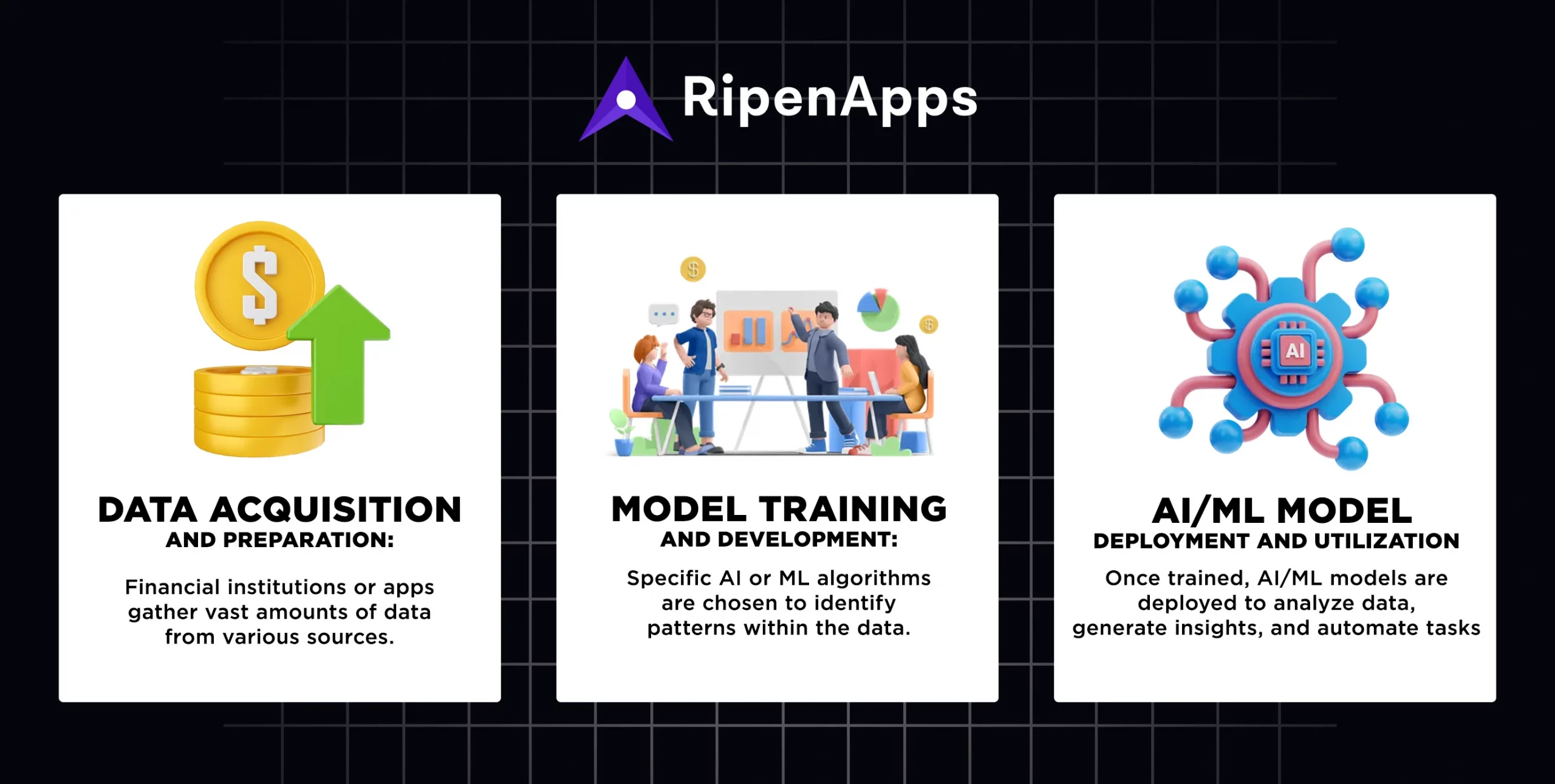

How does AI and ML in Finance Work?

Artificial intelligence and machine learning are advanced-level computational programming. They enable a system of software applications with automated and human-like ability to do various tasks. So, when AI and ML in finance are implemented, they automate several repetitive tasks and strengthen financial processes and operations with high-end features.

For instance, machine learning extracts meaningful insights from a vast amount of raw data. It provides accurate results and helps in making data-driven decisions. In addition to this, machine learning applications had adaptive learning capabilities.

So it can adapt to evolving trends and updates to provide relevant and useful financial outcomes. On the other side, artificial intelligence empowers software or financial applications with advanced solutions. Developers and mobile app development company in USA use AI in finance to build fintech apps and software solutions for improving financial services.

Take a look at the below picture that shows the functioning of AI and ML in finance

How are AI and ML Transforming the Finance Industry?

1. Algorithmic Trading

Algorithmic trading, powered by AI and ML, has revolutionized financial markets. These technologies enable the analysis of vast datasets at incredible speeds. Here, AI and ML algorithms identify patterns and execute trades in milliseconds. These AI-driven algorithms adapt to changing market conditions.

As a result, it allows financial institutions to continuously learn and optimize trading strategies. By automating buy and sell decisions, algorithmic trading reduces human errors, minimizes emotional biases, and enhances market liquidity. Traders can leverage historical and real-time data to make more informed decisions.

Consequently, it maximizes profits and minimizes risks. Hence, this algorithmic trading is empowering traders and financial companies more efficient, data-driven, and responsive to market dynamics.

2. Credit Scoring and Risk Assessment

Traditional credit scoring models often rely on limited data. They have limited resources to accurately analyze the credit and risk associated with financial services. Therefore, many times leads to incomplete financial assessment. However, AI and ML have brought about a paradigm shift in credit scoring and risk assessment within the finance industry.

With AI, current financial models can incorporate a diverse range of data sources, including non-traditional ones like social media activity and online behavior. Besides this, machine learning algorithms analyze this extensive dataset. By deploying ML models in fintech applications business owners can identify useful patterns. They can also find correlations to assess an individual’s creditworthiness more accurately.

Thus, this approach not only expands financial inclusion by evaluating individuals with limited credit histories but also improves risk management for lenders. Hence, the dynamic nature of ML models enhances the precision of credit decisions and reduces the likelihood of defaults.

3. Enhanced Fraud Detection and Prevention

Conventional fintech apps or financial applications often struggle to keep up with the evolving tactics of fraudsters. Especially in the present age when cyber security becoming more crucial, banks, investors, and financial companies have to invest a lot in building fintech applications with advanced features. In this case, AI and ML help them as a powerful tool in making a secure financial app or software.

This is because artificial intelligence and machine learning models excel at identifying anomalies and patterns indicative of fraudulent behavior. By analyzing large volumes of transactional data in real-time, these systems can detect irregularities. For instance, unusual spending patterns or unauthorized access, and trigger immediate responses.

Moreover, ML models continually learn from new data. It enables the application or system to adapt to emerging threats and fraud techniques. Hence, the result is a robust and proactive approach to fraud detection. It not only saves financial institutions from significant financial losses but also safeguards the trust and confidence of customers in the security of their financial transactions.

4. Customer Service and Personalization

Artificial intelligence and machine learning are significantly contributing to enhancing customer service in the finance sector. Today, companies and businesses use AI-powered chatbots and virtual assistants to provide instant and personalized customer support.

These virtual agents can handle routine inquiries, guide users through transactions, and even provide financial advice. Here, machine learning algorithms analyze customer interactions by learning from each conversation to improve responses over time.

Furthermore, AI helps companies to make their customer experience more personalized by understanding individual preferences and behaviors. This data allows financial institutions to customize their financial product or services, and provide recommendations. Thus, they create a more engaging and customer-centric environment.

5. Process Automation

AI and ML-driven process automation have streamlined various financial operations. There are many repetitive tasks such as data entry, document verification, and compliance checks, which consume a lot of time. As a result, it makes the financial processes less productive. However, with the emergence of AI and ML in finance, financial companies are able to take better advantage of automation.

At present, they now use AI and ML-powered applications to automate several repetitive tasks and free up human resources for more complex and strategic activities. This automation reduces the likelihood of errors associated with manual processes, enhances efficiency, and accelerates the pace of business operations.

Whether it’s automating account openings, transaction reconciliations, or regulatory compliance checks, the integration of AI-driven automation in finance results in cost savings and increased accuracy.

6. Robo-Advisors

Robo-advisor is one of the top trends in fintech app development. Many companies and business organizations utilize AI-powered robo-advisors for plenty of purposes. The robo-advisors have democratized access to investment advice and portfolio management.

They analyze user preferences, risk tolerance, and financial goals to provide automated and data-driven investment advice. Robo-advisors leverage sophisticated machine learning models to continuously learn from market trends.

They use historical data to optimize portfolio allocations. As they eliminate human biases and emotions from investment decisions, robo-advisors offer a systematic and disciplined approach to wealth management. Therefore, top-rated app developers and financial companies today use AI and ML-powered robo-advisors due to their various benefits.

7. Predictive Analytics for Financial Planning

AI and ML are transforming financial planning through predictive analytics, With AI and ML in finance, investors and business people are able to make accurate and sustainable financial plans. Financial applications or products using artificial intelligence and machine learning help business owners make well-informed financial decisions.

Today, financial planners leverage predictive analytics to model various scenarios, assess risks, and optimize investment strategies. They use AI and ML tools to analyze vast amounts of historical and real-time financial data, market trends, and economic indicators to forecast future conditions.

This predictive analytics empowers financial professionals to make proactive decisions and adapt strategies accordingly. Therefore, modern financial institutions and individual investors alike benefit from the integration of predictive analytics in finance.

8. Blockchain and Cryptocurrency

Blockchain is also one of the top emerging trends in the finance industry. It is used in various ways to make financial operations more secure and decentralized. Here, AI and ML allow developers to leverage blockchain in mobile apps development services for finance more efficiently.

In the realm of blockchain, AI algorithms are employed to monitor and analyze transactions for security purposes. These algorithms identify anomalies, detect fraudulent activities, and enhance the overall integrity of blockchain networks.

In the context of cryptocurrency, machine learning models are used for predictive analytics to forecast market trends. Traders and investors leverage these insights to make more informed decisions in the highly volatile cryptocurrency markets. Hence, the integration of AI and ML in finance allows companies to leverage blockchain and cryptocurrency to enhance security, transparency, and decision-making.

Top Examples of Companies That Used AI and ML in Finance

1. UBS

It is a global financial services company that utilizes AI for wealth management. They leverage machine learning to analyze market trends, assess risks, and provide personalized investment advice to their clients.

2. Robinhood

Robinhood is one of the famous investment apps. It is a commission-free stock and cryptocurrency trading platform. This application uses AI algorithms for customer support and provides personalized investment recommendations. For this, the app employs machine learning to enhance the user experience and optimize trading strategies.

3. ZestFinance

ZestFinance is one of the leading fintech companies in the USA. They also utilize artificial intelligence and machine learning to improve credit underwriting. The company provides AI-driven credit scoring solutions to assess the credit risk of individuals who may not have a traditional credit history.

4. Capital One

This fintech company applies AI and machine learning for credit card fraud detection and risk management. They use AI models to analyze spending patterns, identify anomalies, and enhance the security of their financial services.

5. Ant Financial (Alibaba Group)

Ant Financial is an affiliate of Alibaba Group. They use AI and ML in finance for their mobile payment platform Alipay. They employ advanced algorithms for fraud detection, and credit scoring, and give personalized financial product recommendations.

Final Thoughts

Thus, seeing the above trends, it is evident how AI and ML in finance are bringing transformative change. Whether you are a financial company, an individual investor, or own a fintech application, the scope of AI and ML in finance is promising.

Every market segment today leverages the powerful benefits of artificial intelligence and machine learning to make their financial services more efficient and productive. However, the use of artificial intelligence and machine learning in the finance sector is currently evolving.

So, it requires a well-defined strategy and expertise to successfully integrate AI and ML in finance. Hence, you should seek assistance from an expert mobile app development consultancy that has proven experience in AI and machine learning app development services.

India

India USA

USA Australia

Australia Canada

Canada UK

UK UAE

UAE