AI and machine learning in money lending has started a new phase of transformation when the fintech industry is passing through dramatic technological advancement.

Especially, the integration of AI and ML into money lending apps is bringin a seismic shift in how financial services are delivered.

Upstart, a fintech company has set a prime example to revolutionize personal money lending through AI-driven algorithms. It was founded by ex-Googlers to create a platform that provides easy access to affordable credit while reducing the risk and cost.

The upstart app has become popular because of its advanced key features such as alternative data analysis, faster approvals, and low default rates due to accurate risk assessments. As more financial institutions adopt these latest technologies, it will lead to faster, fairer, and more inclusive money lending than ever before.

Traditional money lending was a time-consuming process that involved human interaction and manual credit scoring. It leads to long waiting or processing times, an increase in rejection rates, and limited access to credit.

The emerging technologies allow lenders to analyze huge data, access creditworthiness, and automate several decision-making processes. For both borrowers and lenders, it has provided a personalized learning experience. Therefore, today fintech startups now look to work with AI app development company to buid such apps.

In this blog, you will learn how AI in lending is reshaping the fintech industry. You will get valuable insights along with the benefits of implementing AI in the money lending industry. You will also know how emerging technologies are improving accuracy and efficiency to enhance the borrower experience.

Table of Contents

Why The Rise of Money Lending Apps Is Growing?

Earlier, the money lending sector was characterized by manual processes. However, with emerging technologies such as Artificial Intelligence and Machine Learning, the industry is undergoing a dynamic shift.

According to industry reports, AI has great potential to revolutionize the global banking sector and can generate a profit of $170 billion. It is expected to increase by 9% by the year 2028.

Lenders can get the insights of borrower’s creditworthiness to make more informed decisions. Therefore, leveraging AI and ML empowers entrepreneurs to take charge of their financial health. This is increasing the demand and popularity of money-lending apps in the fintech industry.

Technologies such as Al and ML are transforming the finance industry through faster loan processing and approvals. They have also changed the way lenders manage loans. From real-time fraud detection to automated credit scoring, they have changed the process to a great extent.

Key Features of AI-Driven Money Lending Apps

Several key features of AI-driven money-lending apps set them apart from other money-lending platforms. These advanced features enhance the overall user experience and ensure accuracy and efficiency. Also, by following some tips and strategies for creating money lending app, you can lead the industry. If you are facing difficulties in incorporating advanced features, you can seek help from a mobile app development company to build a powerful app.

These are the most notable features of AI-powered money-lending apps :

- AI-powered chatbots to enhance customer service

- Personalized loan offers

- Automated AI loan approval

- Advance risk management

- Real-time analytics and insights

- Seamless user experience

- Bias Mitigation

- Predictive Analysis for Loan Performance

- Dynamic pricing models

- Automated document verification

- Enhanced compliance and Regulatory adherence

- Sentiment Analysis for Customer Feedback

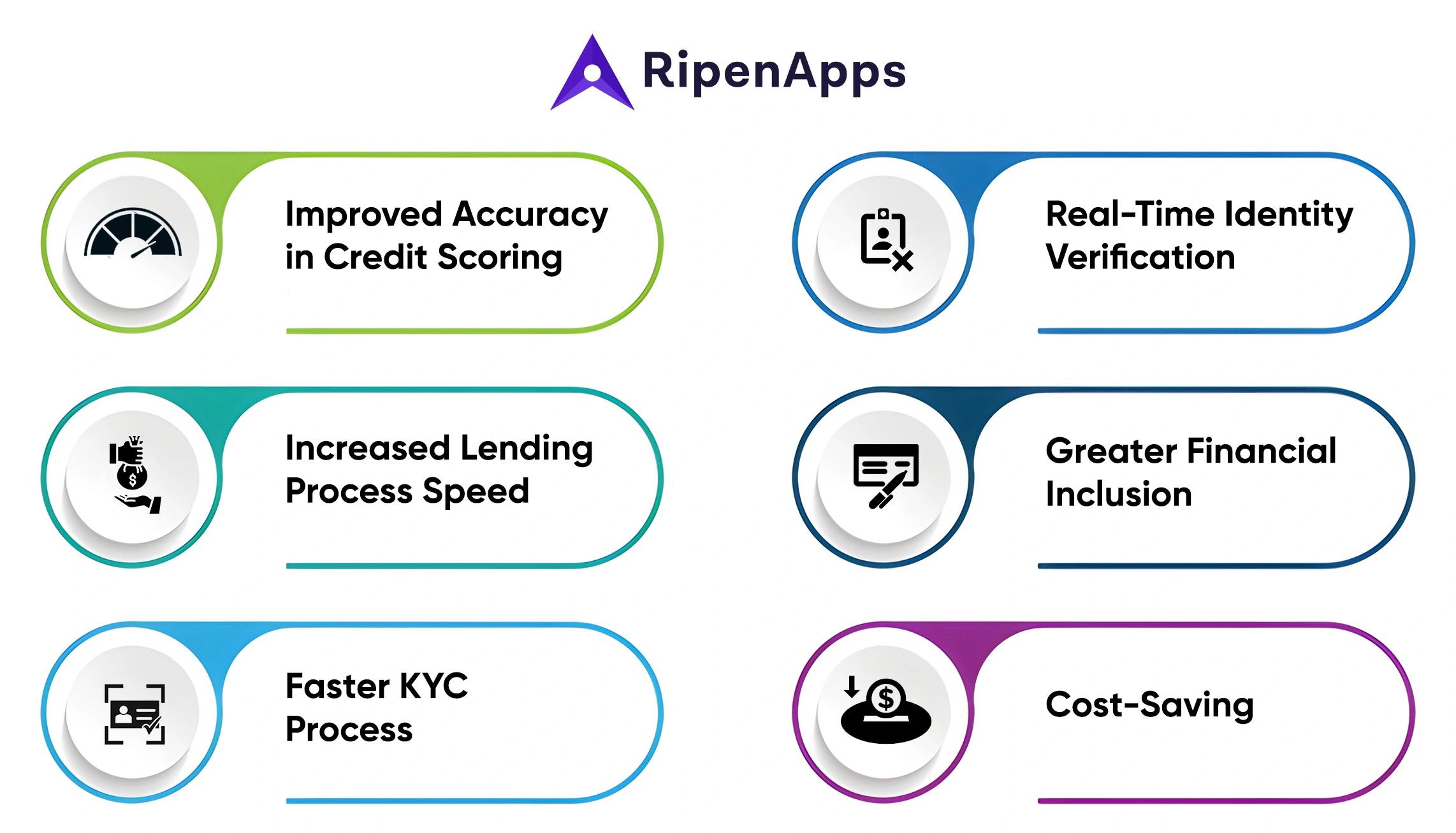

Major Benefits of Using AI and Machine Learning in Money Lending

The integration of AI and Machine Learning into money-lending apps offers several benefits for both lenders and borrowers. The benefits associated with it enhance customer experience, risk management, improved efficiency and accuracy, and many more. Here are some Key benefits of implementing these technologies into your money app.

1. Improved Accuracy Credit Scoring

One of the major benefits of AI and ML technologies is that it has changed the way lenders assess creditworthiness. The AI-driven models can easily analyze a wide range of data. The lenders can get more accurate insights which leads to better decisions and reduced default rates. One can make decisions quickly which reduces the turnaround time to process loan requests.

2. Boost The Speed of The Lending Process

The incorporation of Al and ML in money lending apps helps lenders to increase efficiency which results in a faster lending process. The traditional lending process can be cumbersome and requires extensive paperwork.

AI-driven mobile apps can automate several processes and allow lenders to improve loans within a few minutes. It will enhance the borrower’s experience and they can easily process a higher volume of loans. It will also result in increased profitability.

3. Faster KYC Procedure Like Never Before

When lenders were dependent on traditional know-your-customer(KYC) procedures, they needed to spend a lot of time. However, with the incorporation of AI into a money-lending app, this process is also simplified. This helps lenders to identify customers before granting loans.

There are technologies such as AI-driven optical character recognition that will automatically extract data from documents. Thus reduces the work for manual data entry.

4. Verify User identity in Real-Time

With the help of AI algorithms, lenders can seamlessly cross-check the extracted information in real time. It speeds up the verification process and ensures that the identity of the borrower is authentic or not. The traditional methods of verification can take up several days to complete the entire process.

AI-powered facial recognition technology allows you to compare the user’s photo from their ID documents with a live selfie. Due to biometric verification, an additional layer of security is added which speeds up the entire process and there is no need for other verification processes.

5. Greater Financial Inclusion

Another perk of implementing AI in lending is the potential for greater financial inclusion. The conventional lending model does not include individuals who do not have a strong credit history. The AI-driven apps can easily analyze alternative data sources to assess individual creditworthiness. This has the power to bring all borrowers into the formal financial system. Thus, this benefit of incorporating AI technology also promotes economic growth and equality of opportunities to access financial services.

6. Lenders Can Save More Costs Than Ever

Artificial Intelligence and Machine Learning also help lenders save costs. As they automate several tasks performed by employees, it reduces their overall operational costs.

Moreover, AI-driven money lending apps can help them to optimize their lending strategies in the best possible way. It reduces the risk of borrower’s default and improves the overall profitability. The cost saved by them can be passed to borrowers as low interest rates or lenders can even make credit more accessible and affordable.

How AI and ML Works in the Money Lending Industry?

1. Automates Credit Scoring

The traditional models of credit scoring work on historical credit data and don’t give much chance to potential borrowers. However, AI in the financial sector has overcome the challenge and has come up with other alternative data sources to generate an accurate Artificial Intelligence credit score.

The AI models can analyze new loan applications. It helps lenders to get a comprehensive assessment of a borrower’s creditworthiness and identify potential risks.

This risk assessment can automate the loan approval or rejection process and allow human underwriters to work on higher-priority tasks.

2. Helps in Fraud Detection and Prevention

Artificial Intelligence allows you to detect and prevent fraud which makes your money-lending app more secure. The AI system is used to track transactions and user behavior to identify unusual patterns to easily detect fraud.

One of the major advantages of leveraging AI for fraud detection and prevention is that it mitigates risks and safeguards both borrowers and lenders. The AI algorithms work efficiently to identify various anomalies in transaction patterns. It analyzes real-time transaction data and sends alerts to detect suspicious activities.

3. Automates Loan Process

Al and ML streamline various loan processing workflow. You can create a money lending app to reduce the time and effort for loan approvals.

The AI-powered mobile apps can handle various tasks simultaneously such as document verification, data entry, or compliance checks. Therefore, it allows human resources to focus on more complex activities.

Al and ML models allow you to automate repetitive tasks that result in quicker processing times and reduce your overall expenses. So, if you also looking to accelerate the loan approval process, you need to incorporate Al in money lending apps to quickly analyze data.

4. Personalizing Customer Experience

Business owners can provide custom services as they can easily process vast amounts of information. The AI in the money lending app secures sensitive data which is used to generate personal Artificial Intelligence credit, UCC filings, tax liens, time in business, etc. The AI model generates personalized financial recommendations based on history, trends, and borrower behaviors.

In traditional lending practices, there was no scope for a customized approach. Thus, with the incorporation of AI into money lending apps, businesses can have access to faster- funding options according to their business needs or preferences. Partnering with a globally recognized AI app development company ensures that your app delivers personalized experiences and recommends specific loans to your users effectively.

5. Predictive Analysis for Loan Performance

AI model allows predictive analytics that helps lenders forecast loan performance based on past collected data. In this way, lenders can also address possible issues such as borrower defaults, and late payment and can take necessary preventive measures.

Lenders can manage their portfolios in the best possible way as the AI model provides deep insights into loan performance forecasting. Lenders can implement various strategies to reduce the possible defaults shortly.

Read Also : 8 Best Ways To Use Predictive Analytics for Mobile Apps

Future of Money Lending With AI and Machine Learning

The future of finance and banking sector is shaped by continuous advancement in the latest technologies. These innovations ensure accessible, efficient, and personalized financial services.

The AI-powered algorithms allow lenders to provide services beyond traditional credit scoring models. The AI in lending has reduced the risk and will open up several opportunities for individuals who may have not had a chance in traditional lending systems.

With the evolution of AI in money lending apps, we can expect faster AI loan approvals, quick processes, dynamic interest rate models, and enhanced fraud detection capabilities.

The integration of emerging technologies is likely to foster an inclusive financial ecosystem, where borrowers can easily get access to loans as per their requirements.

Conclusion

AI and machine learning technologies are redefining how creditworthiness is assessed and making the lending process more efficient and secure. With AI-powered mobile apps, lenders can offer personalized financial solutions that cater to the diverse needs of borrowers and minimize the overall risk.

Building your app can be challenging and time-consuming. Therefore, you can connect with a money lending app development company to follow the right procedures to launch your app.

In the near future, AI and Machine Learning will play a vital role in shaping a more fair financial ecosystem which will be beneficial for both lenders and borrowers. So, make sure to build a money-lending app and stay ahead of the curve.

FAQs

Q1. How is AI changing the money lending industry?

AI is transforming the money lending industry by automating several processes such as loan approval processes, better credit assessment, personalized loan solutions, and quicker lending decisions.

Q2. What are the benefits of using machine learning in Money Lending?

Machine Learning and other emerging technologies enhance the money lending process by allowing more precise risk assessments, improving tailored financial solutions, reducing default rates, and optimizing the entire money lending process.

Q3. How does AI help in detecting and preventing fraud in lending?

Artificial Intelligence technology can easily detect and prevent fraud in the money lending process by analyzing different patterns, utilizing real-time data monitoring, identifying fraudulent activities easily, and protecting lenders from potential losses.

Q4. What is the future of AI in the money lending industry?

AI in the money lending industry will provide faster loan approval, more options for personalized lending, improved fraud detection, etc. Therefore, it will drive a better, more efficient, and inclusive lending ecosystem.

Q5. What are the risks or challenges associated with AI in lending?

There are several risks associated with AI in lending such as potential biases in algorithms, concerns related to data privacy, over-reliance on technology, etc. Along with that, there are regulatory challenges as well that impact the fairness of AI-driven decisions.

India

India USA

USA Australia

Australia Canada

Canada UK

UK UAE

UAE