Need $100 till payday? In 2025, millions of people will no longer turn to traditional banks. Instead, they will easily tap their phones and get instant access to funds. All thanks to cash advance apps like MoneyLion, Dave, and others that are bringing a seismic change in the industry. As more & more people are having financial anxiety, these platforms are becoming the go-to solution for urgent financial needs. They are fast, easy, and hassle-free.

This growing shift highlights a massive opportunity, especially for fintech innovators. With users demanding transparency, speed, and personalization, there’s never been a better time to build smart, user-centric financial solutions. Developing feature-rich cash advance apps isn’t an emerging trend; they’re shaping the future of personal finance.

However, if you’re a fintech founder or startup visionary wondering, “How much does it cost to build an app like MoneyLion?”, you’re in the right place.

In this blog, you will deep dive into useful aspects of building a loaning money app, from must-have features to cost breakdowns. This will help you succeed in the booming cash advances apps market. So, stay tuned till the end :

Table of Contents

Decoding MoneyLion’s Success Blueprint

MoneyLion became one of the most popular fintech apps because it mastered the art of blending technology, finance, and providing human-centric experiences. By addressing real user pain points such as financial insecurity, slow access to cash, and lack of financial literacy, MoneyLion created a digital platform that users trust and rely on. Therefore, its success offers a perfect roadmap for startups that are looking to disrupt the cash advances apps or fintech loan apps landscape.

Before we discuss the cost to build a cash advance app like Moneylion, let’s understand the demand:

- Faster, Smarter Solutions: Today’s users want instant help, not long queues and credit checks. As the app provides instant solutions, its demand keeps increasing.

- Financial Inclusivity: Fintech loan apps reach users that traditional systems overlook.

- Personalization with AI: Real-time decision-making makes the experience seamless.

That’s why cash advance apps like MoneyLion and Dave are attracting millions of downloads. You can also build similar apps and capture the huge market share.

What is MoneyLion, and why is it Popular?

MoneyLion is one of the leading U.S.-based fintech apps. The application is popular because it seamlessly blends banking, investing, credit building, and cash advances. The best part is that it provides all in one sleek platform. The app follows a customer-first approach, which sets it apart from competitors. It also offers instant financial help without the hassle of traditional banks. With millions of users and a fast-growing reputation, MoneyLion has become a go-to solution for financial empowerment, especially among millennials and Gen Z.

Here’s what makes MoneyLion stand out and why building an app like it is a smart move:

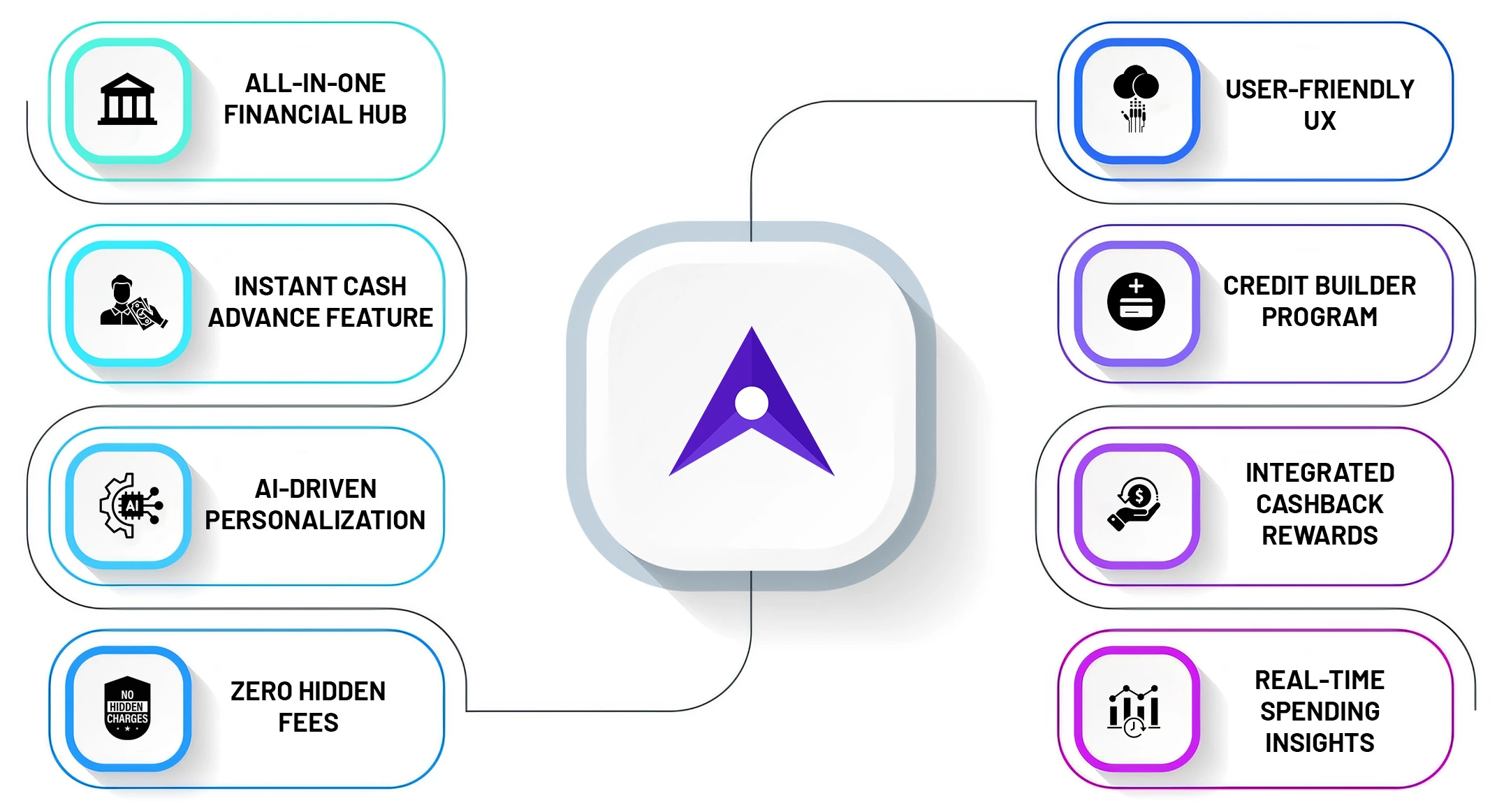

1. All-in-One Financial Hub

MoneyLion seamlessly combines cash advances, budgeting tools, investing options, and credit monitoring. Therefore, it creates unmatched convenience for target users.

2. Instant Cash Advance Feature

Users can easily get up to $500 instantly without interest or credit checks. Therefore, it is highly attractive during financial crunches.

3. AI-Driven Personalization

Due to integration of AI and ML in money lending apps, it tailors financial advice, alerts, and offers. Therefore, it boosts the overall engagement and retention.

4. Zero Hidden Fees

The app’s transparent, tip-based model builds trust, something traditional banks often lack. Thus, the app attracts more target users.

5. Millennial & Gen Z Friendly UX

A clean, intuitive interface with gamified finance features that makes the app feel modern and easy to use.

6. Credit Builder Program

MoneyLion helps users improve their credit scores through manageable, micro-loan-based repayment plans. That’s why it is one of the major advantage for long-term financial health.

7. Integrated Debit Card & Rewards

MoneyLion offers a RoarMoney debit card with cashback rewards and early paycheck access. Therefore, it is turning everyday spending into value-driven financial behavior.

8. Real-Time Spending Insights

The app delivers instant analytics on spending habits. Therefore, it helps target users to stay in control of their finances and make smarter money moves.

Step-by-Step Guide to Building a Cash Advance App Like MoneyLion

Developing an app can be challenging, but you can build it by following a particular strategy and procedure. Here is a step-by-step money lending app development guide that you can follow to build a feature-rich and scalable app like Moneylion :

Step 1: Validate Your Idea & Research the Market

Before diving into the mobile app development process, you need to understand the fintech loan apps landscape. Businesses need to explore what makes apps like MoneyLion and Dave successful. You need to identify gaps, user pain points, and how your app can offer better features or experiences.

Step 2: Choose Your Business Model & Monetization Strategy

The next step is to decide how your app will generate revenue:

- Tip-based model (like MoneyLion)

- Subscription for premium features

- Affiliate marketing with financial products

- Interchange fees from cards

It is advisable to choose what aligns with your value proposition and target users. You can also check out the guide on mobile app monetization to get a much better idea about suitable strategies according to your business.

Step 3: Define Core Features

List out the must-have features that users expect from good cash advance apps. Some features that you can seamlessly integrate into your cash advance app, like Earnin, are instant cash advance, budgeting tools, credit building, real-time notifications, bank account integrations, user onboarding with eKYC, and many more. You can add these features that will set your app apart from other apps like MoneyLion.

Step 4: Partner With a Development Company

To build a secure, scalable, feature-rich, and high-performing app, you need to collaborate with a team that has fintech expertise. Always look for their experience in developing apps like MoneyLion. Not only this, they should know about compliance, data security, and know how to scale up your money lending app as per user dynamic demands.

Need help? Check out the top fintech app development companies in USA or build an in-house team.

Step 5: Choose the Right Tech Stack

If you are building a cash advance app like MoneyLion, you can use a modern, scalable stack that supports fast performance and security. Some popular tech stack for frontend is React Native / Flutter, for backend: Node.js / Django, for database: MongoDB / PostgreSQL, for security: Biometric login, 2FA, AES-256 encryption. However, if you are finding it difficult to choose the right technology stack, then you can also avail of money lending app development services. The industry experts have years of experience to know which tech stack will be best suitable for your cash advance app.

Step 6: Design a Simple, Intuitive UX

Your app should be frictionless, especially for first-time users. Therefore, you need to focus on fast onboarding, minimal steps to access funds, and clear loan/advance terms and user-friendly dashboards. However, remember that the best instant cash advance apps like MoneyLion prioritize ease-of-use for target users. So, make sure of that.

Step 7: Ensure Compliance with Regulations

Cash advance apps must meet financial rules & regulations. For this, you need to work with legal advisors to handle state-specific lending laws, GDPR/CCPA compliance, etc. It is one of the crucial steps while developing a cash advance app like MoneyLion.

Step 8: Test Your App Before Launch

You need to ensure everything works smoothly. Before the final launch, you need to perform functional testing, security & penetration testing, UX testing with real users, performance testing under load, etc. If you find any bugs or technical glitches in between, then you can solve them before the final launch.

Step 9: Launch MVP & Collect Feedback

Don’t wait for perfection. You can launch a minimum viable product with your core features. Get user feedback fast and iterate. This approach helps you compete with free instant cash advance apps while evolving based on real needs or specific requirements.

Step 10: Optimize, Scale & Promote

Even after post-launch, keep improving the performance of your app. For this, you need to critically analyze user data & drop-off points. Based on the feedback, you can add advanced features like AI-driven budgeting. To scale up your app, you can also launch marketing campaigns.

Read Also: Ultimate Guide To Cashback App Development Like Upside

Cash Advance App Development Cost Breakdown

Building a cash advance app like MoneyLion involves several development processes, each contributing to the overall cost. From designing a seamless user experience to developing secure backend systems and integrating real-time payment APIs, every process required careful planning & resources.

Therefore, money lending app development cost varies based on multiple factors such as feature integration, app complexity, choosing the right technology stack, platform choices (iOS, Android, or both), compliance requirements, and many more. To give you a better idea, here is a breakdown based on key aspects that influence the cash advance app development cost:

|

Development Aspect |

Estimated Cost Range (USD) |

Description |

| UI/UX Design | $5,000 – $12,000 | Crafting an intuitive, mobile-first design that boosts user experience |

| Core Feature Development | $25,000 – $50,000 | Building main features like instant loans, budget tools, and notifications |

| Backend Development & Database | $15,000 – $30,000 | Server-side APIs, user management, loan tracking, and data storage |

| AI Integration | $10,000 – $20,000 | Adding AI for smart credit assessment and personalized financial advice |

| Third-Party API Integrations | $3,000 – $10,000 | Banking APIs, payment gateways, and identity verification integrations |

| Compliance & Security Setup | $7,000 – $15,000 | GDPR/CCPA setup, encryption, and audit mechanisms |

| Testing & Quality Assurance (QA) | $5,000 – $8,000 | End-to-end testing for security, functionality, and user experience |

| Deployment & App Store Launch | $1,000 – $3,000 | Publishing apps on Google Play and App Store |

| Ongoing Maintenance (Annual) | $3,000 – $7,000 | Regular updates, bug fixes, security patches, and feature upgrades |

Note: The average cost to build a cash advance app like MoneyLion can lie between $40,000 to $110,000+. However, if you aim to compete with the best cash advance apps like MoneyLion, investing in AI, security, and a seamless user experience is non-negotiable.

Wrapping Up

Building a cash advance app like MoneyLion isn’t just about launching another fintech tool, it’s more about providing users with faster, smarter, and more transparent financial solutions. As we move ahead in 2025, the demand for feature-rich cash advance apps and instant money apps continues to skyrocket. It is mainly fueled by changing user expectations and financial realities.

From diving into essential features, development costs, to compliance essentials for building a money lending app like Moneylion, you must have a clear roadmap. So, whether you’re aiming to create the next best cash advance app in 2025 or a smart MoneyLion alternative, success comes down to one thing: putting the user at the center of everything you build. You can also seek help from a leading fintech app development company to build a feature-loaded app and to thrive in the competitive fintech landscape.

Frequently Asked Questions :

1. How much does it cost to develop a cash advance app like MoneyLion?

The cost to build a cash advance app like MoneyLion ranges between $40,000 to $110,000. It depends on features, tech stack, security layers, and whether you choose native or cross-platform development. However, the more complex the app, the higher you need to do the investment.

2. What features are essential for building apps like MoneyLion and Dave?

Some key features include instant cash advances, secure user onboarding, AI-driven eligibility checks, budgeting tools, real-time notifications, and secure payment integrations. Apart from these, strong UX and data security are must-haves.

3. How long does it take to build a money lending app like MoneyLion?

Building a money lending app usually takes 5 to 9 months. It depends on app complexity, third-party API integrations, and testing cycles.

4. What factors affect the cash advance app development cost the most?

Major factors include app complexity, AI integration for loan decisioning, third-party API costs, compliance/security measures, platform selection (iOS, Android, or both), and whether you’re working with top fintech developers. All these factors directly affect the overall cost.

5. What’s the best monetization model for cash advance apps?

Top monetization models include premium subscriptions, affiliate commissions with financial services, and debit card interchange fees. You can combine models that can help you optimize profitability.

India

India USA

USA Australia

Australia Canada

Canada UK

UK UAE

UAE