When it comes to digital innovations, technical advancement, and smooth transactions in service delivery, India can give global leadership along with the big countries of the world.

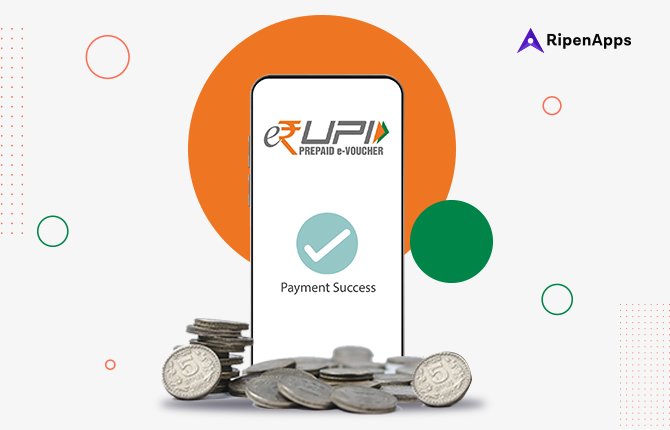

e-RUPI (Digital currency)!!! Taking another step towards digitalization, the Indian government has announced their digital currency to improvise the payment transaction method in a leak-proof manner.

On 2nd August 2021, India Prime Minister- Narendra Modi has launched a new electronic voucher-based digital payment system, “e-RUPI”.

e-RUPI is a cashless and contactless digital payments medium, which will be delivered to mobile phones of beneficiaries in the form of an SMS string or a QR code.

This person-specific & purpose-specific digital payment system has been developed by (NPCI) National Payments Corporation of India, Department of Financial Services (DFS), Ministry of Health and Family Welfare and the National Health Authority(MoHFW).

Table of Contents

What is e-RUPI & how it works?

E-RUPI is a digital payment medium that promotes cashless & contactless norms, which will be delivered to mobile phones of beneficiaries in the form of an SMS string or a QR code. Powered by UPI, this new payment method is launched to provide the monetary.

The government can extend their monetary support directly to citizens in the form of a prepaid e-voucher.

“The voucher is going to play a vital role in making direct benefit transactions (DBT) more effective in digital transactions in India.”

This specific e-voucher will be redeemable only at specific accepting centres without any credit or debit card through a mobile app or internet banking.

It connects the users and sponsors of the services with the beneficiaries digitally without any physical interface.

The entire digital payment system is highly targeted and only can be used for making payment for the purpose it has been issued. So, for example- if the voucher is issued for the vaccine or medicine, it can be redeemable for that only.

Process of e-voucher operation: How it will be issued and works?

The brand new digital payment system has been developed by NPCI on its UPI platform and has onboarded various banks that will issue these e-vouchers.

Government agencies and other corporate agencies can approach the partner banks with the detail of the specific person and purpose for which payment has to be made.

Identification of the beneficiaries will be made using their mobile number and the particular voucher allocated by the bank to the service provider.

The particular voucher’s benefit will be leveraged by the same person whom it has been issued for.

List of On-boarded Banks that would be live with the eRUPI:

Here find the list of the on-boarded Banks that would be live with the eRUPI-

Axis Bank: This will be the Issuer as well as Acquirer. The acquiring app will be Bharat Pay.

HDFC Bank: It will be both Issuer and the Acquirer. The acquiring app will be HDFC Business App.

Canara Bank: It will be the Issuer.

ICICI Bank: ICICI Bank will be both Acquirer as well as Issuer. The acquiring app for this bank is Bharat Pe & PineLabs.

Bank of Baroda: It will be both Issuer and Acquirer. The acquiring app will be BHIM Baroda Merchant Pay.

Indusind Bank: It will be the Issuer.

Indian Bank: It will be the Issuer.

Kotak Bank: It will be the issuer.

Punjab National Bank: PNB will be both issuer and the acquirer. The acquiring app for PNB is PNB Merchant Pay.

State Bank of India: SBI will be both issuer and the acquirer. The acquiring app for SBI is YONO SBI Merchant.

Union Bank of India: It will be the issuer.

What are the Industry-specific advantages of Digital Currency?

As eRUPI is easy, safe & secure as it keeps the details of the beneficiaries completely confidential. It is estimated that this voucher payment medium is going to be relatively faster and reliable.

Here, find the significant industry-specific benefits.

Advantages for Corporate Industry

- Corporates can enable the well-being of their employees

- End to end the digital transaction and doesn’t require any physical issuance hence leading to cost reduction

- Voucher redemption can be tracked by the issuer, as it provides reliability.

- Quick, safe & contactless voucher distribution

Advantages for Hospitals

- Its easy, easy & secure, is authorization can be verified with a verification code.

- Hassle-free & Contactless payment collection.

- Quick redemption process as the voucher can be redeemed in a few steps and lesser decline due to pre-blocked amount.

Advantages to the Customer

- It’s contactless as the beneficiary should not carry a printout of the voucher

- 2 step redemption process

- It is safe and secure as the beneficiary doesn’t need to share personal details while redemption; hence privacy is maintained.

- No digital or bank presence is required.

Reasons why digital currencies are expected to do well in India?

As per the RBI, there are four reasons why digital currencies are expected to do well in India.

- There is increasing penetration of digital payments globally as people are mostly inclined towards paying digitally for every small transaction.

- India’s high currency to GDP ratio, according to the RBI, “holds out another benefit of CBDCs”.

- As the spread of private virtual currencies such as Bitcoin & Ethereum.

- CBDCs might also cushion the general public in an environment of volatile private VCs.

India

India USA

USA Australia

Australia Canada

Canada UK

UK UAE

UAE