If you are thinking of building a payment app like Cash app, you are making a good move.

Why?

In 2024, the Cash app was reported to have 57 million users and generated USD 14.7 billion in annual revenue, which is one of the highest values among other popular apps like Apple Pay, Google Pay, and PayPal.

This is because the mobile payment service market has grown tremendously in the past few years. Consumers today mostly prefer paying through online or mobile payment apps due to cost and time efficiency.

According to the latest reports, the mobile payment market size was valued at $88.50 billion in 2024 and is projected to grow at a CAGR of 38% from 2025 to 2030. (Source: Grand View Research)

Therefore, developing a payment app like Cash is the hottest trend in the mobile app development market, especially in the fintech sector. Many fintech sectors choose the Cash app model to build a payment app offering users multiple payment facilities.

Being a leading fintech app development company, we know how much the demand for mobile and P2P payment apps is growing. Hence, if you are also planning to launch your own app like Cash, here we will guide you on how to develop a payment app like Cash app successfully.

So let’s dive deep:

Table of Contents

What is the Cash App?

It is a P2P (peer-to-peer) mobile payment service application built by Square Inc. Ever since Cash App created, users can transfer or receive money into their bank accounts or wallets directly. It is available on both Google Play and Apple App Store. Cash App provides a variety of services like P2P payment transfer, buying and selling cryptocurrency, crypto trading, sharing utilities, splitting costs, and more.

The cash app creation was led by two entrepreneurs, Jack Dorsey and Jim McKelvy, in 2009. Cash App works as a free mobile application to enable users to safely and quickly send or receive money and do more with their money.

What Features Make Cash App a Leading Payment App in the Market?

Cash App is very popular among users and in the mobile payment market. This app not only provides fast and secure P2P money transfer but also additional facilities that users look for. The online payment apps like Cash App are built with modern technology to offer amazing features that make the payment process smoother and more engaging.

With Free payment apps like Cash App, users can do many things, such as invest in stocks, crypto trading, P2P payment, and more. The Cash App offers a seamless mobile payment experience. Therefore, it has acquired a wide user base and an extensive share of the market. Here are the current statistics of the Cash App that will give an overview of its market dominance

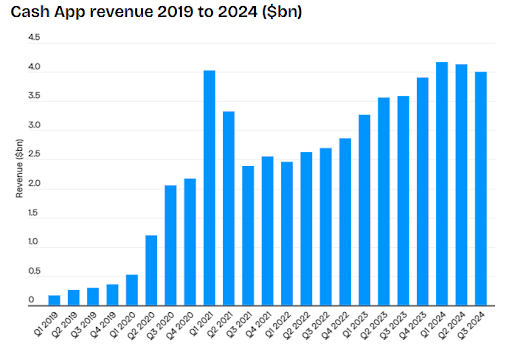

- In 2024, the Cash app produced $16.2 billion in revenue 2024, a 13.2% increase on the previous year.

- Cash App had 57 million monthly active users in 2024.

- Cash App had a gross profit of $5.23 billion in 2024.

- 24 million people had a Cash Card in 2024.

(Source: Business of Apps)

So, seeing these statistics, it is evident how large a market share the Cash app holds in the industry. After the world’s top payment apps like Apple Pay, Google Pay, and PayPal, it is counted among the top-ranked apps. This is because of the prominent features that the Cash app offers to its users-

- Activity Tracking

- Customizable Branding

- Compatible With Bitcoin

- Stock investment

- SSL Security

- Multi-Currency

- Authentication

- Electronic Payments

- Receive Cash Bonus For Referrals

- Secure Data Storage

- P2P Payments

- Allows Users To Invest

- Customer Accounts

- Mobile Access

- Customer Help

- Remote Deposit

- Optional Free Debit Card

- Save Money With Cash Boosts

Why Should You Build An App Like Cash App?

In the current digital age, people mostly prefer using apps and digital mediums for financial activities. Today, the fintech sector is experiencing unprecedented growth. Mobile payments, e-wallets, cashless transactions, and easily accessible investment and financial services are in great demand. Therefore, the popularity of apps like Cash and other mobile payment apps is booming.

With the Best payment apps like Cash App, users can do many things such as invest in stocks, crypto trading, P2P payment, and more. To enhance your crypto trading experience on Cash App, consider using a VPN for crypto trading. A VPN can provide additional layers of privacy and security, allowing you to trade with confidence. By masking your IP address and encrypting your internet traffic, a VPN can protect your sensitive information from potential threats.

Moreover, this app offers a broad range of exciting features and financial services. It enables users to take full advantage of modern financial technology on the go. As a result, users find these apps highly useful and cost-efficient. So, when you ask why you should invest in mobile payment app development like Cash App, here are the prominent reasons-

1. High Growth In Mobile Payment & Online Transactions

Digital transformation and mobile payment technology have revolutionized the way people deal with money and cash. People feel more comfortable and safe with online payment since it offers better privacy and security. Through mobile apps, consumers get faster and easier accessibility to financial services. As a result, the growth mobile and digital payment market is increasing significantly. Therefore, the demand for apps like Cash App, Venmo, Zelle, Apple Pay, and Samsung Pay is increasing. So, developing an app like Cash App is certainly a future-proof idea.

2. Booming Fintech Industry

The fintech industry is booming. People today are highly interested in using a variety of financial apps. Especially, mobile apps that offer seamless online payment facilities along with investment opportunities. Therefore, businesses invest in various app development services like e-wallet app development, mobile payment app development, P2P payment app development, etc. And apps similar to cashapp are among the top choices for fintech startups to establish their venture in the fintech sector.

3. High Revenue Potential

Mobile payment apps have high revenue-generating potential. There are many other kinds of apps similar to Cash App that businesses can develop. Creating a mobile payment fintech app gives a better opportunity to make higher business profits. If you look at the recent market data, other payment apps like Cash App have attained revenues in billion-dollar figures. As told before, the Cash app generated $2 billion in revenue last year. Thus, if you develop a payment app like Cash, you have great potential to earn profits in billions of dollars.

4. Wide Financial Inclusion

Investing in mobile payment app development like the Cash app not only benefits the stakeholders but also the customers. Payment apps like the Cash App bridge the financial inclusion gap by offering widely accessible financial services to the mass population. Traditional banking and financial services take considerable cost and time. As a result, many sections of society or the population are deprived of understanding the role of AI in fintech and leveraging the benefits.

But with mobile payment apps, they get access to a wide range of financial services. People can avail the full benefits of banking, digital payment, investment, and other financial services from anywhere with just a click. Cash App is one of the best examples that has proven a good financial inclusion by offering many additional services on mobile devices, making financial services more affordable and accessible to all.

Step-By-Step Process to Develop a Payment App Like Cash App

Building a payment app like the Cash app is a complex process. It requires in-depth research and integration of various technologies and compliances. You will need good expertise and guidance at different stages to create similar features to the Cash app. Here are the steps to build a payment app like Cash app-

1. Do In-depth Market Research and Planning

The mobile payment service market is one of the significant segments of the fintech industry. This sector involves various financial services like mobile payment, P2P payment, mobile wallet, crypto trading, stock investment, and more. Cash app is not the only key player.

Other apps like Cash App offer similar and additional financial services apart from mobile payment. Hence, before you delve into the mobile app development process, the first step is to define your niche and business goal. You have to conduct in-depth market research and properly define

- What is your app goal?

- Who is your target audience?

- What financial services you would offer?

- Is your app a clone of Cash?

2. Build a Competitor Strategy

This is something crucial. Since, you are solely focusing on creating an app like Cash you are going to compete not only with this app but also with other similar payment apps. The Cash app is only available in US and UK. Hence, if your app’s target audience is also from the US and UK, then you certainly need a dedicated competitor strategy as to how would your app stand out among already successful apps.

However, if you are launching the app outside of the US and UK, things might be easier for you. But today, every market region is filled with apps like Cash. Therefore, you have to create a strategic P2P payment app development plan in the very beginning stage.

Top Payment Apps in the USA

- Apple Pay

- Google Pay

- PayPal

- Cash App

- Venmo

- Zelle

- Samsung Pay

3. Choose the Tech Stack for Payment App Development

Once you have prepared your development strategy, it’s time to select the technology stack. There are several tools and frameworks available. Based on your app development requirements, you have to choose a suitable tech stack for building another app like Cash App.

While the selection depends on various factors such as OS platform, type of app, features, etc., however, below are listed technologies and frameworks that could be used for developing payment apps like Cash app.

- Frontend development frameworks: Android SDK for Android, iOS SDK for iOS

- Programming languages: Java and Kotlin for Android, Swift for iOS

- UI/UX Design: Adobe XD, Figma, Sketch

- Backend development frameworks: Node.js Express.js, Django,

- Database: PostgreSQL, MySQL, NoSQL

- Server hosting: AWS, Google Cloud Platform (GCP), Azure

- Cryptocurrency Integration (if applicable): Cryptocurrency APIs like Coinbase or Binance

- Cloud Services: AWS (EC2), CDNs like Cloudflare or Amazon CloudFront

4. Hire a Dedicated Mobile App Development Company

App development like the Cash app is a high-level process. You will need expert technical assistance to build a full-fledged app. Therefore, you have to hire a top rated mobile app development company that specializes in creating mobile payments. You can outsource your project to them and share your requirements. And based on this, they will turn your vision into reality.

5. Ensure Legal Compliance

There are certain data regulations and compliance policies that apps like Cash App with debit card need to comply with. Before you launch your app, it is very critical to ensure your app also abide by all the laws and compliances. Ensuring these fintech app development companies not only protect your app from legal restrictions but also establish trust and credibility among the audience. Therefore, this step is extremely important. Below are some of the popular companies that a P2P payment app must follow

- Federal Trade Commission (FTC) in the USA

- Anti-Money Laundering (AML)

- General Data Protection Regulation (GDPR) in Europe

- California Consumer Privacy Act (CCPA) in the USA

- EFTA (Electronic Fund Transfer Act)

How Much Does it Cost to Build an App Like Cash App?

The cost to develop a P2P payment app like Cash App might fall between $50,000-$70,000. However, this cost might vary depending on various factors. The Cash App has been built with a native development approach. It means they deployed platform-specific resources for app development. As a result, the cost is relatively higher. However, if you are developing your own cash app software with a cross-platform development approach, then the cost will be low. Hence, it is better to get clear with your requirements and then get an exact cost estimation.

Read Also: How to Develop a FinTech Mobile App: An Exclusive Guide to Finance World

How Does an App Like Cash App Ensure the Application’s Security?

When you create a Cash App, security should be a top priority. Handling sensitive user data and financial transactions requires next-level protection. That’s when you use Cash App security features. Let’s understand how Cash App ensures the safety of your information and payments:

1. End-To-End Encryption

All communications and transactions, including Cash App successful payments, are protected with powerful end-to-end encryption. This security feature secures the data and makes it inaccessible to hackers during transmission. You can hire dedicated mobile app developers to include this security feature in your app similar to Cash App.

2. Multi-Factor Authentication (MFA)

Cash App integrates multi-factor authentication, such as passwords, PINs, and biometric login options like Face ID or fingerprint. It makes your account secure even when someone accesses your device. However, this feature is advanced, but it doesn’t increase the money lending app development cost.

3. Real-Time Fraud Detection

A strong fraud detection engine works behind the scenes of every Cashapp successful payment. AI and machine learning are already transforming this sector. These apps use AI and behavioral analysis to detect suspicious activity in real-time. After detecting activities such as unusual login attempts or abnormal transfer patterns, businesses can freeze accounts to prevent damage.

Read Also: Leveraging AI For Fraud Detection And Prevention In FinTech Apps

4. PCI-DSS Compliance and Secure APIs

Compliance is very important when you develop an app similar to Cash App. This application adheres to PCI-DSS standards and uses secure APIs. It ensures safe handling of cardholder data and protects against injection attacks.

5. User-Controlled Security Settings

This feature provides users with the power to manage their account’s safety. They can lock cards, log out of sessions remotely, get real-time alerts for every activity, and control spending. This level of control improves trust, and it is increasing in apps like Cash App with debit card integration.

Cash App Alternatives

We are in a digital economy where peer-to-peer (P2P) payment platforms like Cash App have become household names. From online banking features, international support, to payment methods like Cash App, let’s explore what apps are similar to Cash App:

1. Venmo

Venmo is a social-friendly app similar to Cash App which is great for quick transfers between friends. This app supports bank linking, debit, cards, and lets users split bills. All of this can be done with emojis and social feed. This is a strong alternative because it has easy-to-use interface and offers a physical debit card.

2. PayPal

PayPal is one of the oldest players in the game and it’s more than a Cash App alternative. Being trusted by global businesses and individuals, this app is accepted by thousands of merchants. It supports international transfers and used by freelancers and small businesses.

3. Zelle

If Cash App availability is limited in your bank, Zelle can be a better fit. This has directly integrated into many US banks’ mobile applications. Zelle is a popular mobile application that eliminates the need for a separate app. It allows you to move money between bank accounts. This application is great for users with established banking relationships.

4. PhonePe

PhonePe is backed by Walmart, and it is one of the popular payment applications in India. This application allows users to transact in e-Rupi via Unified Payments Interface (UPI). It allows users to send money, pay bills, recharge, and even invest. This app can be linked directly to your bank via UPI. PhonePe is widely accepted for both P2P and merchant payments. The updated version of PhonePe offers gold purchases, insurance, and mutual fund investments.

These applications have achieved success in the industry and many people use it in their daily lives. Businesses can make something unique like these apps and establish a strong foothold in the industry. However, it requires partnership with a reliable Fintech app development company to build advanced payment app like Cash App.

Wrapping Up

In the current digital-driven age, consumers are increasingly adopting mobile apps for money transfers and making online payments. Cash App is one of the top successful payment apps that has established its market dominance by offering a great mobile payment facility along with additional benefits.

Therefore, building an app like Cash app is undoubtedly rewarding and future-proof. However, since it requires high technical expertise, it is wise to consult a professional app development company that can assist you in building a full-fledged app like Cash App.

FAQs

Q1. What are the different types of payment apps available?

There are several types of payment apps available, including peer-to-peer (P2P) transfer apps, digital wallets, mobile banking apps, and merchant payment apps. Each app serves specific use cases like splitting bills, online shopping, or contactless payments in stores.

Q2. What are the key features of a payment app?

Key features of a payment app include user registration, bank account integration, instant money transfers, transaction history, real-time notifications, and security protocols like two-factor authentication and encryption.

Q3. How much does it cost to create a custom P2P payment app?

The development cost can range between $25,000 and $130,000. However, it depends on several factors, such as app complexity, integration of advanced features, technology stack, and the development team’s location. Apart from this, ongoing maintenance, industry compliance, and security features can also influence the total investment.

Q4. Why choose us for your P2P payment app development?

We have years of expertise in providing secure, scalable, and user-friendly payment solutions. From idea validation to deployment and support, our expert developers offer end-to-end services. We have the relevant FinTech experience to ensure your app stands out in the competitive market.

Q5. Is there another app like Cash App?

Yes, there are several apps similar to Cash App. Some popular alternatives are PayPal, Zelle, Venmo, Google Pay, and Apple Pay. These applications provide similar functionalities like P2P payments, and features like investment or debit cards.

India

India USA

USA Australia

Australia Canada

Canada UK

UK UAE

UAE