When it comes to pitching to investors, startups often commit various mistakes. As a result, they failed to capture the investor’s attention and convince them to invest. Being a startup, preparing the right pitch deck is a very crucial task since it determines the initial growth of your newly-established venture.

According to CB Insights, 47% of startup failures in 2022 were due to a lack of funding and financing. And 25% of new business ventures don’t get sufficient funding required to launch their business, resulting in restricting their growth. So, securing funding is a serious concern for business founders.

And here at RipenApps, we have helped plenty of startups worldwide by providing them with top-standard solutions and assisting in raising funds over million dollars successfully. We know what investors mostly look for while funding or investing in new startup ideas and where startups commonly commit mistakes while pitching to investors.

If you are also a startup and planning to raise funds from investors, here we have shared the 15 common mistakes when startups pitch to investors. Our team interviewed some investors and they shared the mistakes that startups generally commit while pitching for investment.

So, this post will give you a good idea of how not to pitch for startup funding and learn to avoid them for a successful deal.

Table of Contents

What Is A Startup Pitch Deck?

A pitch deck is a slide presentation that startups or entrepreneurs give before investors to raise funds or investments. A startup pitch deck usually contains a well-planned and brief presentation of 10-20 slides. It provides an overview of the business idea, technology-employed, and other essential things for seeking investment to build the startup growth.

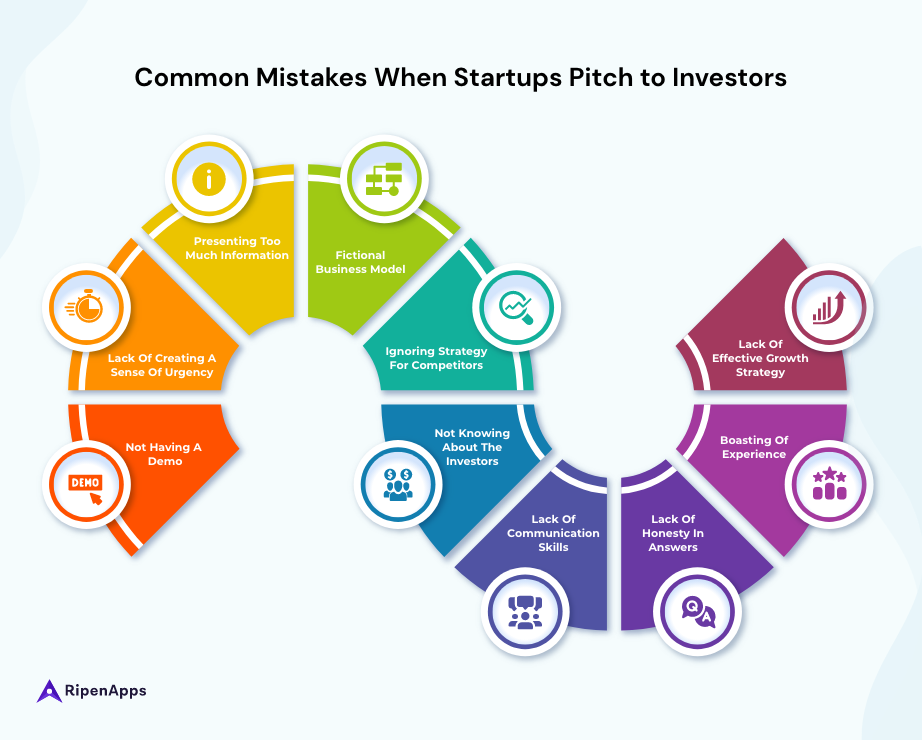

15 Common Mistakes Startups Make When Pitching To Investors

1. Not Having A Demo

If you have an MVP ready or a working prototype to demonstrate in front of investors, it could aid positively in raising start-up funding. In case you have a SaaS product or mobile app development project, make sure it should be in a functional state with real-life results. Don’t try to show future development plans as they might not be a strong influential factor. Angel investors mostly prefer to invest in startups that have proof of concept or a demo backed with a solid ongoing development plan.

2. Lack Of Compelling & Coherent Narrative

A good business story always leaves a good impression whether it gets successful in the future or not. While most startups generally focus on preparing constructive slides undermining the importance of a catchy opening and a compelling narrative. And this is where they lack.

To impress investors, startups have to come up with an attention-grabbing opening and an impressive explanation of the business vision so that the pitch deck captures the investor’s attention in the first few seconds. Graphs and market reports alone are not sufficient. If your story narration is tired or broken, you might fail to hold investors.

3. Lack Of Creating A Sense Of Urgency

Does your pitch deck involve a sense of urgency? If not, then you are committing a great mistake. Investors try to look for an investment opportunity that has better and more secure market scope. If your product or startup idea can not establish the urgency of adoption, you might lose the deal. This factor is especially important when startups pitch to investors for pre-seed funding.

4. Presenting Too Much Information

This is one of the most common mistakes when startups pitch to investors. They try to show first irrelevant information like product features, the technology used in product development, etc. Many startup founders often prepare presentations of over 50 slides. But the fact is, All this technical information does not matter to investors.

They don’t put great attention into going through detail and reading all the points you have mentioned. Generally, investors spend hardly 3-4 minutes listening to your presentation. Thus, if you think a well-technically crafted presentation will convince investors, sorry to say, but it won’t work.

5. Lack Of Clarity In Business Vision & Growth Strategy

Where do you see yourself in five years?, many of us have encountered this popular question in HR interviews. For HR, this question does not matter strongly. But when it comes to pitching a deck for startup funding, it matters a lot. Investors always want to ensure their investment doesn’t go in vain.

And they determine this by analyzing the growth strategy and future roadmap of the startup. You can’t just stand with a great product idea without any vision. To get the confidence of investors, you have to define a concrete vision statement and growth strategy.

6. Not Understanding Your Market & Niche

Many startup founders and business owners dive deeper into finding great business concepts. Whether it is an enterprise-level SaaS product, a billion-dollar app idea, or an innovative device, business owners and entrepreneurs believe the innovative solution has a better chance of market success. However, investors are usually not interested in investing in cool ideas or never-built products.

They don’t like to bet their money on unproven concepts. Investors primarily look at why your startup has chosen this market and how much potential it has in the upcoming years. If you could not provide strong data to convince you why you choose your market, investors will lose interest in your incredible idea.

7. Not Demonstrating Traction

It is also among the most common mistakes when startups pitch to investors. Traction is one of the critical factors which demonstrate the trustability of your vision in reality. When you have started working on your product or idea and have come to some level of development stage like building an MVP. It established trust in investors that you are seriously working on your idea.

8. Fictional Business Model

Most startup founders attempt to pitch their business model in a flimsy or fictional way that appears attractive in hearing but has no legs on the real ground. If you are also thinking of presenting slides with a Boombastic representation of the business model, sorry to disappoint you but it is the case that works.

Many startups often get into the hype of getting funding without the need for a properly-curated revenue model just like other startups acquire funds. However, VC firms and angel investors deeply look into a startup’s long-term revenue plan. Trying to capture investors just by having a six or one-year revenue plan won’t work.

9. Ignoring Strategy For Competitors

No matter what industry or market you choose, there are plenty of competitors. Even if you come up with a creative or unique idea, still there would be some related market competition. When Henry Ford started working on his unique idea of mass car production, even his competitors were horses because they were used as alternatives at that time.

Therefore, when startups pitch to investors, they must explain their competition level and effective strategy for competing with the competitors. But it is often seen, startups and business founders often don’t focus too much on their competition strategy, and this is one of the most common mistakes when pitching to investors.

10. Not Highlighting The Whole Team Slide

Various business founders don’t give much value to highlighting the whole team cluster while pitching to investors. They mostly end up presenting slides that cover their entire advisory board, and the background of the startup founders, and just mention the names or titles of the team without providing any valuable context. It is a pitch deck mistake.

This pitching approach doesn’t help startups get funding from investors. You have to give value to the entire team cluster right from the top hierarchy to the lower execution team mobile app developers, product engineers, sales team, etc., which work closely in your product or delivering service. Investors assess the startup’s capability by seeing the experience, skills, expertise, and other abilities to ensure they have the right team for implementing the idea.

11. Not Knowing About The Investors

One of the common mistakes that startups make while pitching to investors is not knowing in detail about the investors. Mostly, startups don’t research investors to find out in what domains investors are interested, how much money they invest, etc. This specific approach opens more chances of targeting the right investors. Otherwise, approaching with the same pitch deck to all the investors is a mistake that should be avoided.

“Companies that just blanket email every investor they can find with poorly targeted pitches are frankly wasting their time and the investors’, which is not where you want to be. Do your research, be targeted and smart and you’ll get better results.”

– Eamonn Carey, Managing Director at Techstars Connection.

12. Lack Of Communication Skills

Poor or lack of confidence in communication is one of the common mistakes when startups pitch to investors. Many founders and entrepreneurs don’t polish their communication and negotiation skills. And as a result, they fail to sell their pitch and ideas. Sometimes. It is believed an innovative idea will alone drive the deal. But this is a myth. If you are unable to effectively communicate and convince the audience, even the best idea can go empty hands.

13. Lack Of Honesty And Transparency In Answers

Data and statistics are effective ways of pitching to investors. However, when startups fall into overstating facts and market figures things become worse. It is because investors have a realistic awareness of the current market state and how things work on practical ground. Founders sometimes don’t stay very honest and transparent with their answers and presentation and try to surpass the reality of getting investment. And this reduces trust in investors about your skills.

14. Prioritizing More On The Future Than the Present

Investors and VC firms indeed expect startups to have a concrete plan. This makes them assure that the startup in which they are investing is capable of producing sustainable profits in the long run. But many times, founders over-prioritize their plans undermining their present execution strategy. This shows you are more into a dreaming mentality and not leveraging the current opportunity. Consequently, investors will assume you are like an immature startup founder.

15. Boasting Of Experience

It is good to be confident in your words and presentation while pitching to investors. But when startup founders and entrepreneurs start exaggerating their experience and capabilities, things get wrong. You should present the unique qualities and features of your product or business idea. But you need to make sure you don’t oversell your experience while pitching as a dishonest pitch always leads to failure in getting the trust of investors.

The Bottom Line

Convincing investors for start-up funding is not an easy way to crack. Investors seek several strong and valid reasons before investing in any business or product idea. For startup founders and entrepreneurs, analyzing their pitch deck is crucial since it saves them from potential failure.

And the above are the common mistakes when most startups make while pitching to investors. The best way here would be to consult a professional digital product development company that can assist you validate your product idea and craft a compelling pitch for startup funding.

FAQs

1) What is the major mistake most start-ups make while pitching?

The biggest mistake that startup founders and entrepreneurs do is to go for pitching to investors for funding without having a properly defined growth strategy and proof of allotted resources in the present.

2) How to prepare a deal-grabbing pitch deck for startup funding?

There are many factors you need to consider before and while presenting your idea to investors. For instance, telling a compelling story, bringing an innovative solution, being honest and realistic, and more. The best way would be to take assistance from a professional product development agency or firm since they have proven experience in helping startups for raising funds.

3) What do investors mostly see in a startup when pitching for funding?

Investors primarily look for financial stability and future-proof growth strategy with proof related to the present execution. They expect a realistic but intelligent approach that ensures their investment doesn’t go in vain.

India

India USA

USA Australia

Australia Canada

Canada UK

UK UAE

UAE